Empowering Possibilities Through Proven Capabilities

- Home

- Tools and Resources

Unleashing Our Capabilities for Strategic Growth

At Anar Capital, our capabilities are built on a foundation of deep industry knowledge, strategic foresight, and an unwavering commitment to driving growth. We provide end-to-end investment expertise, starting from identifying high-potential opportunities to executing and managing investments for maximum impact. Our ability to navigate complex markets is complemented by our strategic advisory services, where we offer tailored guidance to help businesses achieve their objectives while mitigating risks. Leveraging our vast global network, we foster connections that enable access to innovative partnerships and market-leading opportunities, creating value across borders. In addition, our understanding of regulatory frameworks across different regions ensures that our investments remain compliant while remaining flexible and agile. Our focus on precision market analysis equips us to anticipate trends, identify emerging markets, and make informed decisions that position our partners for success. Finally, we support operational excellence by offering the tools, strategies, and frameworks that optimize business processes, enhance performance, and drive sustainable growth. With these capabilities, we are dedicated to empowering the next generation of leaders and innovators, enabling them to thrive in an ever-evolving market landscape.

Bloomberg Terminal

A powerful platform that provides real-time financial market data, news, analytics, and trading tools.

PitchBook

Specializes in private market intelligence, offering in-depth data on venture capital, private equity, and M&A deals.

Thomson Reuters Eikon

A sophisticated financial analysis platform offering advanced data visualization, economic indicators, news, and trading tools.

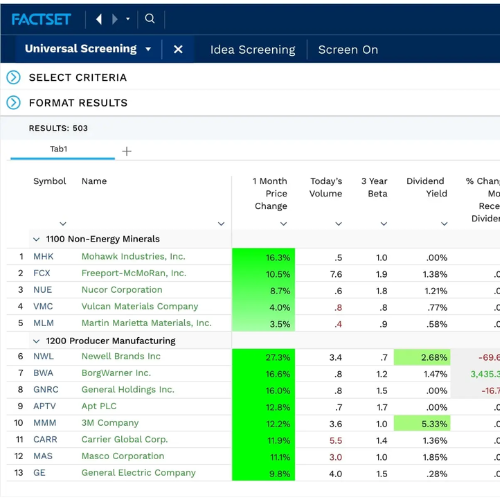

FactSet

An integrated financial information and software solution used for portfolio analytics, quantitative research, and risk management.

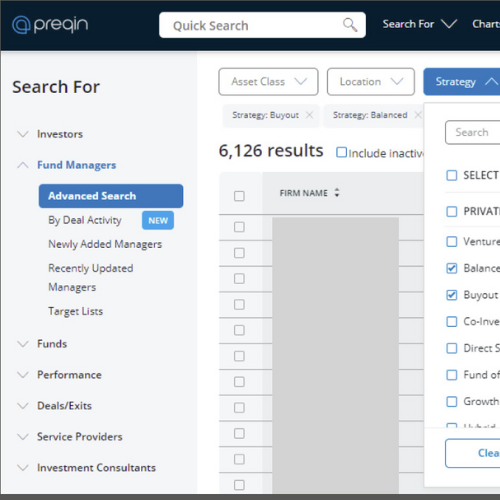

Preqin

The go-to resource for alternative assets—providing data on private equity, hedge funds, infrastructure, and private debt markets.

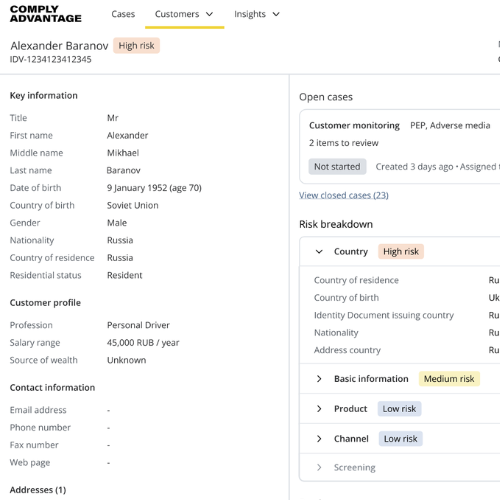

ComplyAdvantage

An AI-driven compliance platform for anti-money laundering (AML), risk screening, and transaction monitoring.

Take the Next Step Forward

Connect with us now and discover how we can help you unlock new opportunities and achieve your goals.